”We invest in companies in upheaval situations and enable these to unfold their full potential by cutting complexity and driving innovation.

Dr. Stefan BrungsManaging Partner Automotive

”We invest in companies in upheaval situations and enable these to unfold their full potential by cutting complexity and driving innovation.

Dr. Stefan BrungsManaging Partner Automotive

Investment Focus

We focus on situations with a clear need for active, operational and strategic support.

Companies or business units with a healthy core, that are underperforming or no longer of strategic interest to their owner, are our strategic focus. We open new possibilities for their sustainable development and provide management capacity and expertise as well as financial resources to make them shine again.

Typical Investment Situations

Corporate Carve-Outs / Spin-Offs

- Business units or subsidiaries of larger corporates that are no longer of strategic importance to their owner and have been classified as “non-core”

- Often heavily integrated into the parent company organization and independence must be established as part of the transaction

- In some cases, have significant value recovery potential

Underperforming Companies / Turnarounds

- Businesses that operate below the profitability of their peers or repeatedly fail to meet expectations – for internal or external reasons

- Often these lack management capacity, historically received insufficient investment in equipment or product innovation and/or require structural changes to their cost structure

Other Special Situations

- Family-owned businesses with unresolved successions

- Complex and/or difficult shareholder or banking situation

- Companies requiring immediate, in-depth restructuring or are in distress

Strategic Acquisitions (“add-ons”)

- Businesses that have strong strategic fit with one of our portfolio companies

- A wide variety of situations – from insolvent or loss-making to comparable, above-average profitability

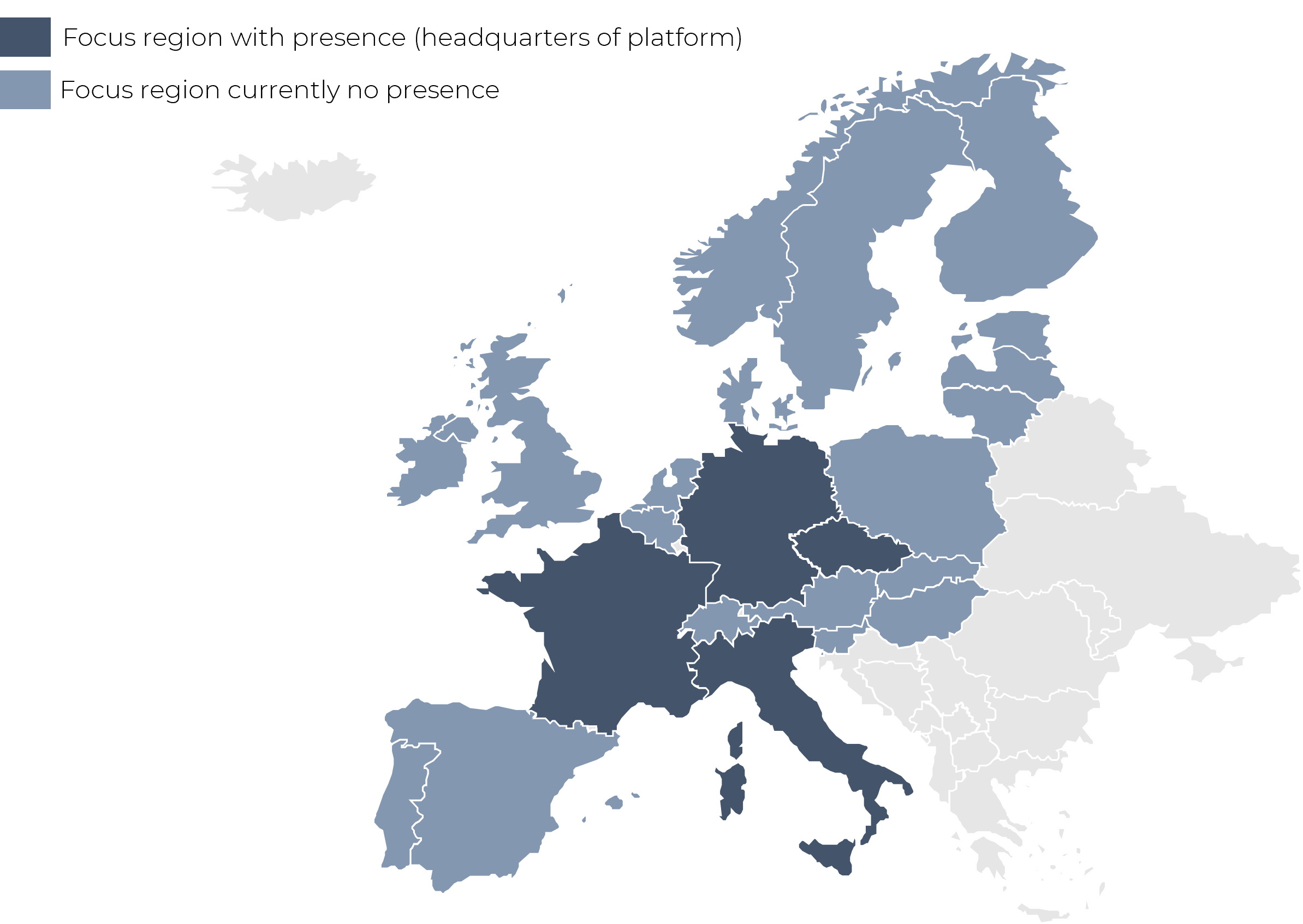

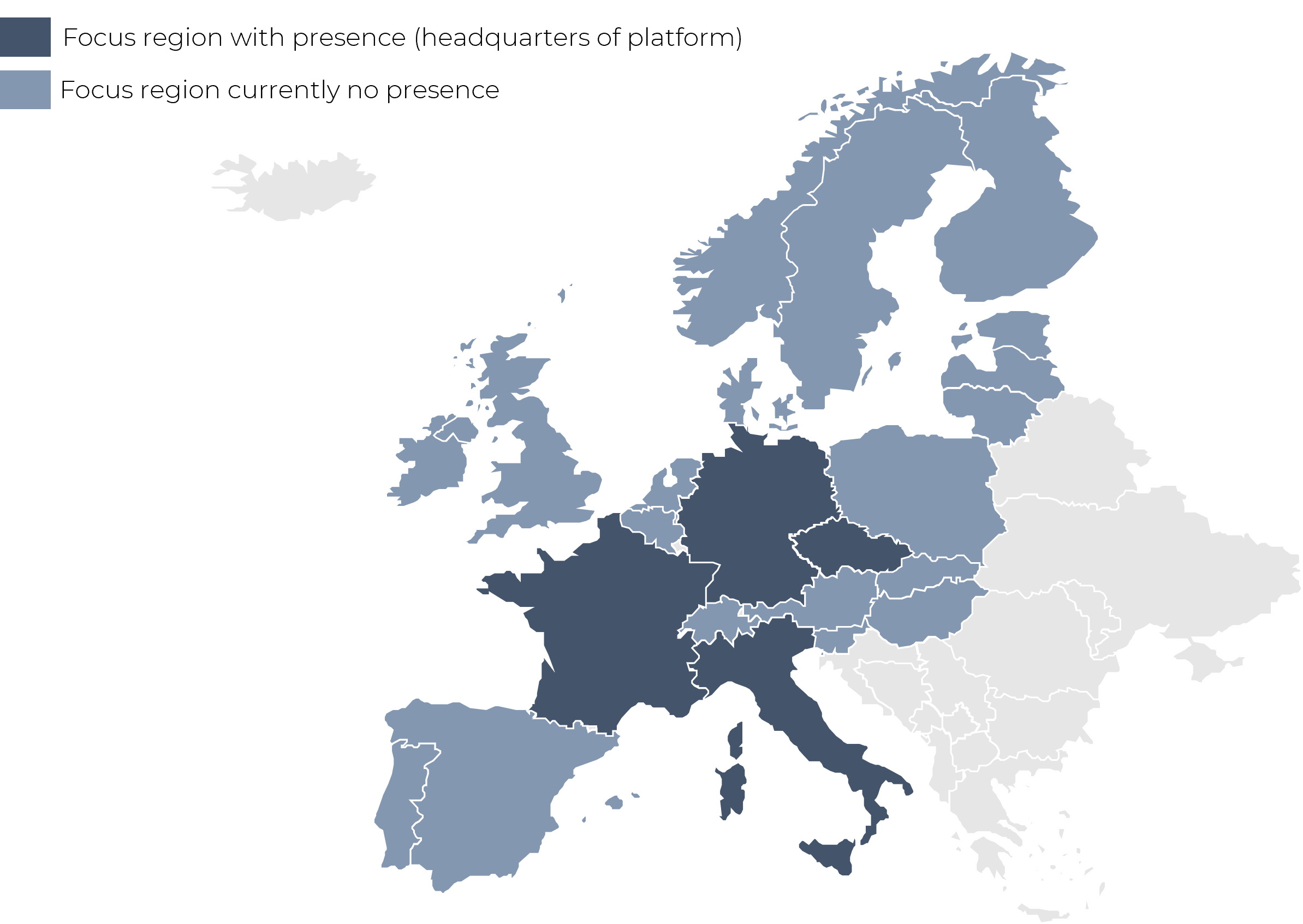

Regionally focused, open to all sectors

Investment Criteria

Regionally focused, open to all sectors